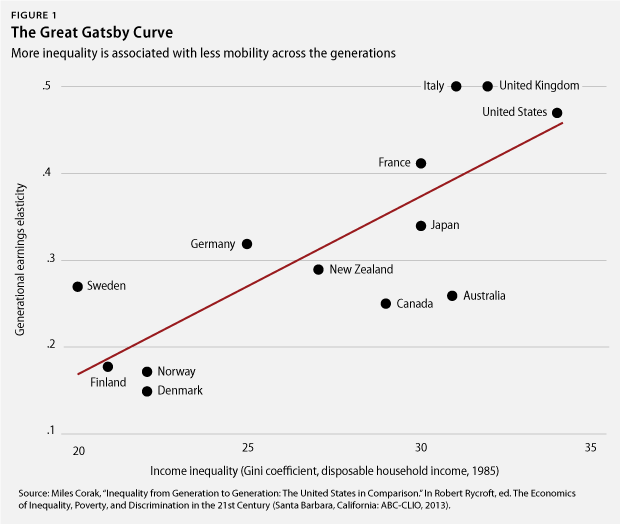

The Center for American Progress has released a study I wrote called “How to Slide Down the Great Gatsby Curve: Inequality, Life Chances, and Public Policy in the United States”. Here is an excerpt:

Tag: social mobility

The US Senate wonders about tax policy for the American Dream: How can income transfers be designed to benefit all children in need?

The tax system is increasingly used to transfer cash benefits to families with children, but the United States accepts the trade-offs in program design very differently than other countries and gives children much less support.

In response to my July 10th testimony to the Senate Committee on Finance hearing on “Helping Young People Achieve the American Dream” I received some homework, a series of questions asking me for a good deal more detail. You can review all of the questions on my November 11th post. Child poverty is central to discussions of social mobility, and it is natural to wonder how tax policy can be designed to support the incomes of the least advantaged.

The US Senate wonders about tax policy for the American Dream: Do parents act in the best interests of their children?

How should programs intended to support children in low-income families be designed if parents don’t always act in the best interests of their children?

This question, among others, was posed to me in response to my July 10th testimony to the Senate Committee on Finance hearing on “Helping Young People Achieve the American Dream.” You can review all of the questions on my November 11th post.

In one way or another they address the fundamental drivers of the extent to which children grow up to be adults having the same socio-economic status as their parents. Family background matters for life chances because of three related forces: inequalities originating in the labour market, the capacity of families to invest in the skills and aptitudes of their children, and the degree to which public policy levels the playing field.

What parents do matters a good deal, and a question posed by the Committee Chairperson, Senator Max Baucus, recognizes this, and wonders about the implications for the design of public policy.

The US Senate wonders about tax policy for the American Dream: why are schools failing to promote social mobility?

The American education system is of relatively more advantage to the relatively advantaged. As a result it does less than it could to promote opportunity.

In response to my July 10th testimony to the Senate Committee on Finance hearing on “Helping Young People Achieve the American Dream” I received some homework, a series of questions asking me for a good deal more detail. You can review all of the questions on my November 11th post, but a couple of questions posed by the Committee Chairman, Senator Max Baucus of Montana, speak to probably the most important driver of social mobility, and raise particularly important issues for public policies.

The US Senate wonders about tax policy for the American Dream: Senator Hatch asks about the validity of the statistics

Senator Orrin Hatch has a sharp eye.

In response to my July 10th testimony to the Senate Committee on Finance hearing on “Helping Young People Achieve the American Dream” I received some homework, a series of questions asking me for a good deal more detail.

Senator Hatch, who is a US Senator for Utah, asks a thoughtful question about measurement issues. I will offer my answers to all the questions in a series of blog posts over the coming days. You can review the questions at my November 11th post. But I would like to begin with the first question Senator Hatch asks because it gives us the opportunity to clarify what the statistics mean. This is a good place to start.

Inequality and top income shares in Canada: Recent trends and policy implications

Inequality has increased in the majority of rich countries, but the share of income and earnings going to the top has increased most in the anglophone countries. McMaster University economist Mike Veall says Canada has not escaped this trend, and argues that a public policy response is needed.

The underlying causes of, in his words, “the surge” in the shares of the top 1%, one-tenth of 1% and even the top one-hundredth of 1% in Canada remain elusive. Even so these changes should motivate at least three policy responses that could be supported across the political spectrum.

Professor Veall was the 2012 president of the Canadian Economics Association, the professional association of economists based in Canada, and presented his presidential address at the annual meetings of the Association held last June at the University of Calgary.

Professor Veall was the 2012 president of the Canadian Economics Association, the professional association of economists based in Canada, and presented his presidential address at the annual meetings of the Association held last June at the University of Calgary.

Continue reading “Inequality and top income shares in Canada: Recent trends and policy implications”