Emmanuel Saez of the University of California at Berkeley has updated his work with Thomas PIketty on the evolution of US Top Incomes to 2010.

He finds that:

“In 2010, average real income per family grew by 2.3% … but the gains were very uneven. Top 1% incomes grew by 11.6%, while bottom 99% incomes grew only by 0.2%. Hence, the top 1% captured 93% of the income gains in the first year of recovery. Such an uneven recovery can help explain the recent public demonstrations against inequality.”

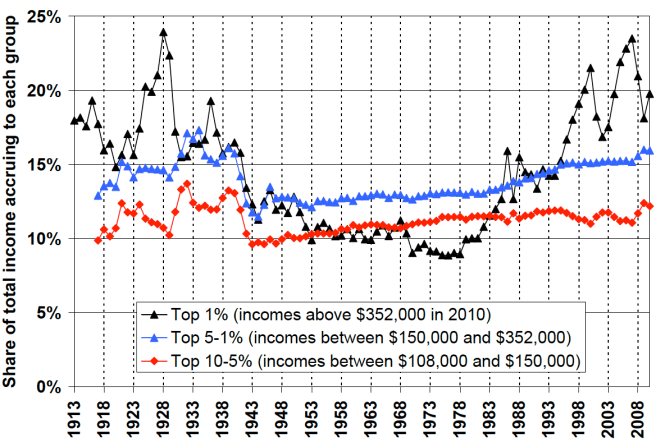

The 10 page update offers a clear picture of how income shares have varied over different business cycles, as well as the long-term trends since 1917. Top income shares fell dramatically after World War II, stayed flat, then began to rise in the early 1980s and have returned to their pre-War levels.

The top 10% in the US take now take home about 47% of all income, but this is driven by the top 1% who account for 20%.

The difference between the business cycle of the 1990s and the 2000s is that the incomes of the bottom 99% grew by 20% between 1993 and 2000, but only by 6.8% between 2002 and 2007.

Saez suggests that this “may … help explain why the dramatic growth in top incomes during the Clinton administration did not generate much public outcry while there has been a great level of attention to top incomes in the press and in the public debate since 2005.”