I have a new job! During the 2017 calendar year I am the “Economist in Residence” at Employment and Social Development Canada. I report to the Deputy Minister of this very large federal government department responsible for the major threads in Canada’s social safety net—insurance, investment, and income distribution that enhance capabilities and opportunities promoting the freedom Canadians have to lead the lives they value.

Jean-Yves Duclos is the Minister responsible, and his mandate letter is full of challenges, not least of which involves leading the development of a Canadian “Poverty Reduction Strategy,” and improving the Employment Insurance program to reflect the changing nature of work.

I report directly to the Deputy Minister of Employment and Social Development Canada, and my position is formally structured as an “interchange” with the University of Ottawa, where I will return in 2018. You can think of me as being on “loan” from my university to the public service.

The “Economist in Residence” is a new position in this department, but is modeled on a longstanding program at the Department of Finance called the “Clifford Clark Visiting Economist.” This program invites outside experts to visit the Department of Finance and work on relevant public policy issues that depend on department priorities, and also mesh with the visitor’s skills and interests. My appointment is an instance of another department doing something similar, at least for one year.

The Canadian public service is organized very differently than in the United States, where political appointments lead to a major churning of senior levels as each new government starts its mandate. This does not happen at all to the same degree in Canada, leading to greater continuity among senior management and a non-partisan basis for hiring and promotion. Some people see this as a great advantage, fostering a professional public service, but others also note some downsides, stressing the importance and value of renewal.

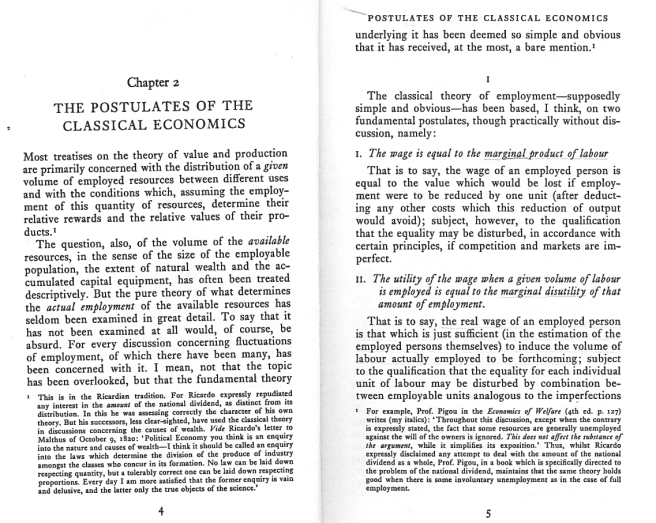

My job description asks me “to provide rigorous and objective advice on a range of key policy issues.” This is a refreshing opportunity, and it is exactly what I intend to do. Indeed, rigorous and objective advice is the tone I have tried to set on this blog, so if you are curious to know more about me—where I stand, how I think, what I’m interested in—feel free to read on!