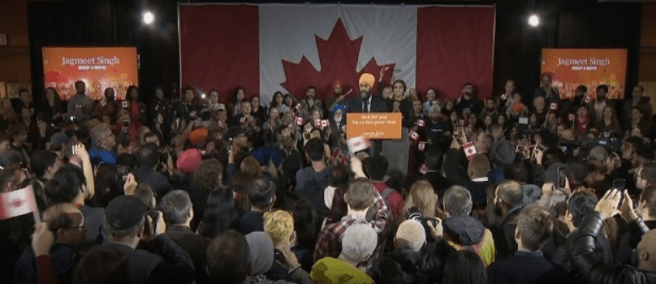

Jagmeet Singh’s promise in his election night speech that “we’re going to make sure the super wealthy start paying their fair share” was met with cheers, the decibel level rising as his fellow New Democrats chanted: “Tax the rich! Tax the rich! Tax the rich!”

It is not entirely true that the federal election ignored big policy issues, but if it was issues-driven, how did a wealth tax fly under the radar?

At some point in the coming weeks Mr. Trudeau will meet Mr. Singh over coffee to talk tax policy. Sadly, the election left Canadians no wiser as to what divides progressives on the issue, but if you want the full picture look south to the Democratic leadership campaign.

Continue reading “Tax the rich! Tax the rich! Tax the rich? But why?”