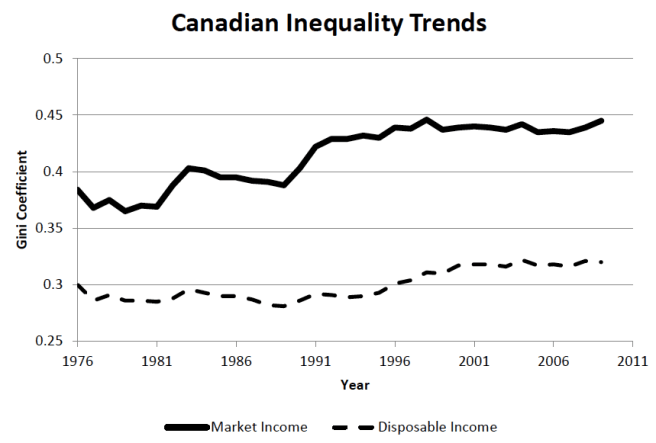

While inequality in Canada has increased over the course of the last three decades, the tax and transfer system can significantly reduce disparities in market incomes. But the political will to use the tax system may be limited, and public policy needs to address underlying labour market developments if it is to pursue an agenda of greater equality.

This is one of the major themes arising from a recently released discussion paper by a group of labour economists from the University of British Columbia: Nicole Fortin, David Green, Thomas Lemieux, Kevin Milligan, and Craig Riddell.

Continue reading ““Canadian Inequality: Recent Development and Policy Options””