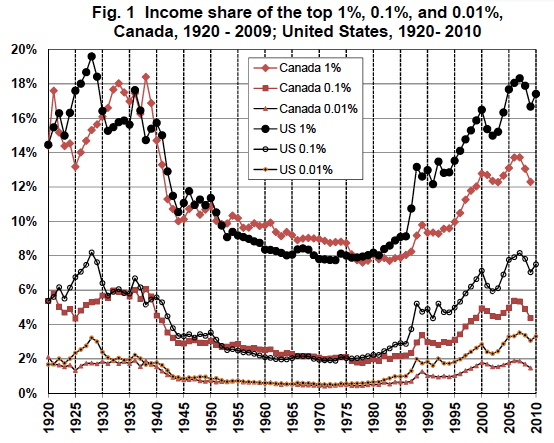

Inequality has increased in the majority of rich countries, but the share of income and earnings going to the top has increased most in the anglophone countries. McMaster University economist Mike Veall says Canada has not escaped this trend, and argues that a public policy response is needed.

The underlying causes of, in his words, “the surge” in the shares of the top 1%, one-tenth of 1% and even the top one-hundredth of 1% in Canada remain elusive. Even so these changes should motivate at least three policy responses that could be supported across the political spectrum.

Professor Veall was the 2012 president of the Canadian Economics Association, the professional association of economists based in Canada, and presented his presidential address at the annual meetings of the Association held last June at the University of Calgary.

Professor Veall was the 2012 president of the Canadian Economics Association, the professional association of economists based in Canada, and presented his presidential address at the annual meetings of the Association held last June at the University of Calgary.

The soon-to-be published version, called Top income shares in Canada: Recent trends and policy implications, in part updates his earlier work with Emmanuel Saez originally published in 2005: The Evolution of High Incomes in Northern America: Lessons from Canadian Evidence.

The research points out that top income shares fell during the recent recession, the top 1% making about 12% of all income in 2009 down from about 14% in 2007. It is unlikely that this signals a change in the upward trend since the early 1980s.

Professor Veall also finds that there is significant variation across provinces with Alberta, British Columbia and Ontario experiencing the most significant increases in top shares, and he suggests that the differences between Canada and the United States—the reported top income shares being greater in the US—are probably overstated by the data, implying that top shares are more similar in the two countries than they appear.

The underlying explanations for higher top income shares are still not clear, though it appears that Canadian developments represent a spillover from the United States for those working in a globalized labour market.

An intriguing piece of evidence to support this latter notion is that the trends in top shares for residents of Quebec who file their tax returns in English are much more pronounced than those who file in French.

Just as interesting are Veall’s views on the policy implications. He suggests that there is probably not much scope to raise marginal tax rates on the very rich, but favours a broadening of the base:

… my review of research on tax responsiveness in Canada leads me to believe that … there is some risk that increases in the top marginal tax rates might raise little or no revenue. If the goal is to increase taxes on those with high incomes, I would argue that the immediate priority should instead be broadening the personal income tax base, particularly eliminating tax preferences that are likely to be taken advantage of by the upper end of the income distribution. (page 24)

The preferential treatment of different types of capital income is one of his concerns.

He also suggests the need for public policy to focus on corporate governance, noting that shareholder democracy is too weak in Canada and that insider power has contributed to excessive executive pay. Citing the research of Randall Morck of the University of Alberta, he also suggests that this has contributed to the under-performance of Canadian corporations.

His final policy priority is the impact that inequality has on inter-generational mobility. He points out that Canada’s position on the so-called Great Gatsby Curve, is enviable in that the strength of the tie between a child’s adult earnings and family background is relatively weak.

But this reflects the accomplishments of the past, particularly social investments in health care and education. Many provincial governments, where the responsibility for these programs lies, are facing important fiscal challenges, and in Veall’s view it is important to address these challenges in a way that preserves the programs that are at the heart of equality of opportunity.

[Update added November 11, 2012: here is the version of Mike Veall’s paper published in the November 2012 issue of the Canadian Journal of Economics: Veall CJE Presidential address November]

2 thoughts on “Inequality and top income shares in Canada: Recent trends and policy implications”