The Canadian federal government should enhance the human and financial capital of children in less wealthy families, enhance market incomes of lower paid workers, and enhance the security of working incomes by adapting three existing programs to new realities: widening their scope, making them more flexible, and making them easier to obtain.

The changing world of work is also a changing world of pay, a world that will likely lean toward greater wage rate inequalities, lower or stagnating incomes for the bottom 40 percent, and greater income insecurity for the broad majority.

I suggest three changes to current public policies that take incremental, but important, steps toward fostering capital accumulation among children from less wealthy families, increasing market incomes earned from that capital for the working poor, and finally enhancing income security for the broad majority.

These policies lean toward encouraging inclusive growth, in which the benefits of the new world of work and pay are broadly shared.

In this post I discuss the first policy proposal, which is:

Enhance human and financial capital by making community colleges tuition-free, and making the Canada Learning Bond more flexible

It is often and repeatedly stressed that the changing nature of work requires a more highly skilled workforce, and continual retooling and reskilling over an individual’s working life. “Reskilling,” “second chances,” “life-long learning,” are all repeatedly used catch-words. The federal government’s Advisory Council on Economic Growth went so far as to suggest that charting a “path to prosperity” requires making Canada a “Learning Nation.”

If this is the case, if enhanced and repeated skills development is essential to both national and individual prosperity, then public policy should recognize this necessity and remove all financial barriers to the development of core competencies.

Just as the move from an agrarian to an industrial economy was accompanied and promoted by free primary and secondary education, so now the move from an industrial to a service economy should be accompanied and promoted by free technical education. Removing financial considerations from this third tier of education recognizes the necessity of skills for prosperity, and the need to continually retool and reskill.

The Canadian federal government offers important financial incentives for parents to save for the higher education of their children, but those directed to lower-income families are not all that more generous and tend to suffer from low take-up rates.

The Registered Education Savings Plan is the linchpin of these programs, a savings account in which the returns are tax-free but which must be used for education spending.

This program has a life-time contribution limit of $50,000. It clearly offers a tax benefit to the relatively well-to-do, those who have the security of being able to save. However, the Canada Education Savings Grant adds a mildly progressive element, offering a grant of 20 percent on the first $2,500 of annual contributions regardless of family income, and an additional 10 to 20 percent to children from low and middle-income families to a lifetime limit of $7,200.

This limit amounts to somewhere between one and two years of tuition for some programs in some community colleges. The Canada Learning Bond enhances these benefits for low-income families by a maximum of $2,000: $500 for each child at birth, and $100 for each year until 15 years of age. The parents must have a Registered Education Savings Plan for the child, but need not make any contributions.

However, this money is left on the table by many, the take-up rate for the Canada Learning Bond, though growing, most recently amounting to only about one-third of eligible children, though there may be reason to question this figure.

Current government policy aims to give parents more information about approaching a financial institution in order to open an account, with some innovative policies being piloted by Budget 2018. The administrative hurdles to making this program automatic, simply opening an account on the parents’ behalf and contributing the funds in escrow, seem to be—so government officials tell me—too challenging.

Take up rates are low, in part because low-income, childbirth, and other worries are important stressors on parents … they simply have a lot of other things to worry about, and it is much easier to put off a decision about saving for a distant future.

Research has shown how we all, rich or poor, are subject to a limited “cognitive bandwidth,” and that those living in poverty are particularly prone to discounting future benefits. While policies intended to offer more information about how to apply for savings programs make sense, they are no substitute for automatic enrollment. Making community college free can be considered as amounting to auto-enrollment, removing the need to make a decision about benefits that will only be realized decades down the road.

This said, it may well be that some parents consider themselves to be making a “rational” decision from their point of view by not saving for their child’s post-secondary education. After all, there is an optimal level of schooling that varies between individuals. The design of the Canada Learning Bond does not recognize this, offering no flexibility on how the funds can be used.

The rate of return to education varies between people, but for everyone falls with more and more education. Being able to read and write and demonstrate basic numeracy will add a good deal more to your income than being able to do differential calculus and obtaining a PhD in economics. Somewhere in between these extremes the return to an extra year of schooling falls below the return to investing in financial or other physical assets, and should at that point stop. Beyond this point investments should be made in financial capital.

Perhaps parents, rightly or wrongly, sense this. But whether they do or not, their children as adults will be best placed to decide whether they should use what capital they have to further their education, or to invest in a new home, or use it for other things. The lack of flexibility in the use of the Canada Learning Bond lends a paternalistic aspect to the policy.

Remember, the federal government gives people with higher incomes a good deal more flexibility when subsidizing their savings, offering tax-based incentives not just for education, but also for a first home and retirement through Registered Retirement Savings Plans, or basically anything at all through Tax-Free Savings Accounts, which can be used by well-to-do parents to enhance the financial assets of their children.

The changing world of pay will lead to a changing world of wealth, and part of developing an inclusive society involves promoting the wealth of those from less-well-to-do families. Wealth should be understood to be based on both human and financial capital.

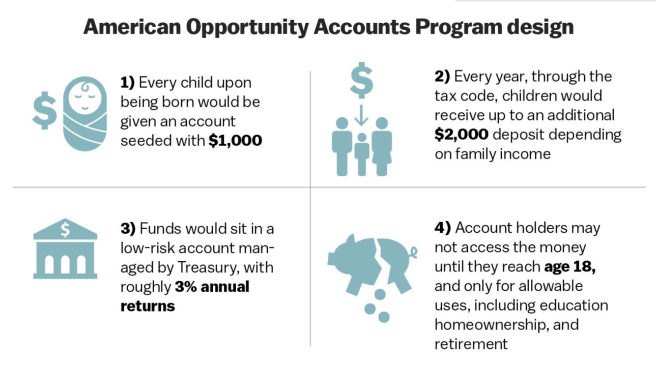

The Canada Learning Bond is an existing policy that can be more generous and more flexible to promote financial wealth in the manner that US Senator Cory Booker has suggested. His proposal for “opportunity accounts” embody the spirit of the Canada Learning Bond, but are more accessible in offering auto-enrollment, and more flexible in offering opportunities to invest in education or in a home or for retirement.

My arguments in this post expand a presentation called “The Changing Nature of Pay: Three Policy Proposals,” that I made to the Queen’s Institute on Social Policy at Queen’s University in August 2018. The other proposals are the subject of future posts and include: enhancing in-work income support by growing the Canada Workers Benefit and integrating it with the Working While on Claim Provisions of Employment Insurance; and offering wage insurance by enhancing the Targeted Earnings Supplement and making it an accessible component of regular Employment Insurance benefits.

These proposals are hardly a complete public policy package for the changing world of pay, but they are feasible and can be quickly implemented since they build upon existing policies that either are not broad enough in scope or purpose, not carefully and seamlessly integrated with other policies, or are not appropriately targeted and delivered.

Download the presentation as a pdf, and watch it here:

I am grateful to officials at Employment and Social Development Canada who prepared a series of helpful background documents. You can load the document on the Canada Education Savings Grant and the Canada Learning Bond as a pdf.

Prof Corak, Your policy prescription of flexibility in the learning bond is in my opinion certainly a step in the right direction. It amounts to a greater subsidy to the low income student enrolled in tertiary education. In so far as the problem of human capital accumulation among the low income child is related to the shortage of financial capital , then your policy recommendation should display a positive outcome in the future. But suppose the problems are more sociological than financial? In particular do low income children display a lower enrollment rate because they are not socialized ( like their middle class counterparts) to think of tertiary education as necessary to their future well being. If this is the case then a further policy may be to actually expose such students to the various offerings of the community colleges / universities in their region / province. As said in the movie silence of the lambs …you covet only what you see. Maybe a supplemental policy measure should be scheduled mandatory visits to community colleges / universities , so that students will be made aware at a young age of the numerous options available to them. By expanding their horizons in their formative years , it may very well be that the young children in poor families will put the necessary pressure on their parents to enroll in the various incentive programs which currently exist …..so enhancing the take up rate.